The M&A market is on the up in Italy and firms are looking to take full advantage of the positive trend. Of particular note is the increase in investment coming into the country, with global companies such as Hitachi and ChemChina making moves into the region.

“We have good companies in Italy and the main players in the private equity and industrial sectors have noted the growing interest in the Italian market,” says Chiomenti Studio Legale’s co-managing partner Filippo Modulo.

These views are echoed by a number of other Italian managing partners, including Legance head Alberto Maggi, who believes he has “never seen the market like this”.

“Investors are identifying the quality of the economic environment,” he adds. “There are many opportunities in the industry and the number of Italian firms making acquisitions in other jurisdictions is also increasing.”

At the start of last year, NCTM advised Hitachi Systems as it acquired Italian IT services company Cosmic Blue Team in one of its first attempts to strengthen its businesses in Italy and throughout Europe. ChemChina also signed an agreement with Camfin in 2015 to purchase the share capital of tyre company Pirelli, for which Pedersoli e Associati and Chiomenti Studio Legale were among the firms providing Italian law advice.

The improved economic climate prompting this surge in Italian M&A has been attributed to a number of factors. The main one is the political stability of the country giving investors more faith in doing business within its borders. Plus, there has been a push for Italian exports following investment from private equity funds that were previously afraid about investing in Southern Europe. At the end of last year, Chiomenti Studio Legale worked on the Gavio Group’s asset purchase of Brazilian toll-roads operator Ecorodovias for around €529m (£402m) as Gavio subsidiaries Astm and Sias looked to focus their strategy on internationalisation.

“It’s been a stabilising environment in Italy politically in terms of constitutional reform and public administration,” says Pedersoli e Associati partner Carlo Re. “The prime minister has been trying to bring forward projects and this has had a positive effect on investors.”

A different economy

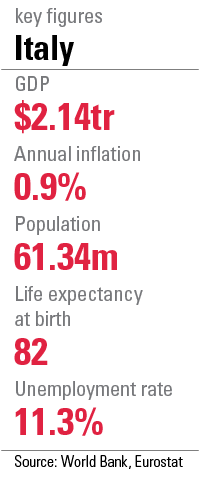

Italy’s GDP has been growing after several years of decline; a number of regulatory changes have been put forward demonstrating economic progress. The Italian banking reforms of the last few years are beginning to have an impact, with the government banning cross-appointments in financial institutions to prevent conflicts of interest, introducing prudential reporting duties and imposing new requirements for implementing the Capital Requirements Directive. The largest mutual banks are also meant to be re-organising themselves into joint stock corporations, forcing changes in their internal corporate governance.

It is expected these regulations could pave the way for big finance deals in the market, with a number of transactions already in their initial stages. Four smaller banks are due to be restructured, while two of the largest banks are also said to be in merger talks, in one of the first signs of consolidation in the market.

“The number of Italian firms making acquisitions in other jurisdictions is increasing”

“Some banks had problems in the aftermath of the financial crash and transactions were under much scrutiny,” says Bonelli Erede Pappalardo managing partner Stefano Simontacchi. “The banks were not as large as they should have been, so there is a lot of activity in the sector now and the regulations are stricter.”

The Italian economy has seemingly taken longer than other European countries to get back to normal after the crash, with places such as the UK and Germany seeing a pick-up in corporate activity far earlier on.

“There were various external factors after the crisis which SMEs needed to digest,” adds Simontacchi. “How quickly Italy recovered was different compared with the UK and Germany as we have a differently structured economy. We don’t have as many large institutions as these nations, but have lots of small and medium-sized businesses. It’s taken a while for these companies to get stronger than they were before.”

In light of this, one of Gianni Origoni Grippo Cappelli & Partners’ main aims is to expand its Italian client base to appeal to the mid-size companies trying to grow worldwide. The firm already counts a number of large internationals among its major clients, including General Electric, Mitsubishi Electric Corporation and Vivendi, as well as large-sized domestic companies such as electricity supplier Enel, bank Cassa Depositi e Prestiti and railway operator Ferrovie dello Stato.

“We’re trying to concentrate on the mid-size companies that are looking towards international expansion,” explains senior partner Francesco Gianni. “We’d like to develop our client base, as these mid-sized businesses are becoming more aggressive as they look overseas.”

“Litigation has normally been handled by the smaller boutiques, but now it’s more complicated”

Re agrees, noting that a lot of the firm’s clients are going abroad.

“They are seeing international expansion as a way to balance their portfolio,” he says. “Investment companies are looking at the business world on a global level and trying to diversify their investment portfolio.”

Moving abroad

The internationalisation of Italian companies has been a catalyst for independent firms setting up shop elsewhere and a number are continuing to focus on their global footprint. Grimaldi Studio Legale opened in London in 2014, while Portolano Cavalo launched in New York just last year. Carnelutti Studio Legale followed suit soon after, forging a joint venture with US firm Altieri Esposito & Minoli.

However, other independents are sticking to the network model. Legance just has offices in Milan, Rome and London, having announced plans to launch in the UK capital in 2012.

“Since we started the office in London,” explains managing partner Alberto Maggi, “clients have viewed our firm as a helpful partner for foreign activities. In the UK, we have Italian lawyers practising Italian law and we’re mostly active in the banking, finance and M&A sectors.”

The firm works with a limited number of firms in other jurisdictions in order to co-ordinate its outbound activities, alluding to the benefits of having “continuity in these relationships”.

This year it has worked on a number of key international transactions, including Ferrrari’s proposed initial public offering on the New York Stock Exchange, advising alongside Loyens & Loeff, Sullivan & Cromwell and Maisto. Sullivan & Cromwell also partnered with Legance on Cyberonics and Sorin’s agreement to merge, with the firms representing the former on US, UK and Italian legal matters.

“Being an Italian lawyer in a large global firm means you’re not where the top decisions are made”

Pedersoli similarly operates via an international network, working last year with UK local partner Macfarlanes on the Economist sale to Italian investment vehicle Exor. Exor has been particularly active in the past year, also turning to the firm and US advisers Paul Weiss Rifkind Wharton & Garrison on its $6.4bn (£4.5bn) proposal to acquire reinsurer PartnerRe.

“We’ve been working to internationalise our practice and strengthen the relationships with our clients in order to become a reliable partner,” says Re. “We could have been out of the picture in the really international UK and US deals, but we have, in fact, been in the picture.”

Facing challenges

While last year saw Italian firms making moves in the US, the next area of focus could well be Asia, with firms such as Pedersoli keen to develop its relationship with banks and local law firms. Gianni Origoni also signed a formal alliance agreement with Chinese law firm Hun Kun Law Offices last April, demonstrating its intention to play more of a role in the continent.

This comes in spite of Asia being a difficult market, admits NCTM partner Vittorio Noseda. “It’s been a good year in Shanghai, but not a period of significant growth,” he says. “It’s a different market to the one in Europe and the West, and it’s difficult to be seen in such a huge country.”

But how are the global firms, which have made their mark in Asia, facing up to the challenges of the Italian legal market? The unsurprising view from the independent firms is that the global players are not placing Italy at the heart of their European strategies or flocking to the country in the same way as the German marketplace.

“The global firms need to be here to serve their clients and banks,” says Simontacchi. “But being in one of the large global firms means you’re not where the top decisions are made and that’s something partners don’t like in terms of their independence and remuneration.”

These sentiments are echoed by various Italian managing partners, who add that the global firms are struggling to hire large teams to their offices. However, many of 2015’s big-name hires have been made between the global firms, with DLA Piper hiring a nine-strong Ashurst team in October after losing eight lawyers to Dentons. Dentons is also the only global firm to launch in the country in the last few months, demonstrating a lack of movement in the region.

“Global firms are having more success in other countries,” says Chiomenti Studio Legale’s co-managing partner Filippo Modulo. “They’ve tried to take their place in the Italian market but it’s hard to start with and you need a sufficient number of lawyers. Lawyers in independent firms don’t have an incentive to jump to other firms.”

“The Italian economy was in a difficult place and global firms have been extremely cautious”

The Italian economic climate has been highlighted as one of the reasons for global firms’ trepidation about entering the country, with Italy’s political climate said to have created a volatile environment in which to do business.

“The Italian economy was in a difficult place and global firms have been extremely cautious,” explains Noseda. “Italy is a difficult environment and so I doubt they’d want to hire more people.”

Strong relationships

With the M&A market picking up, global firms may start to focus more on their Italian capabilities so they can serve their global clients investing out of and into the country. However, for the meantime it appears that the Italian companies are sticking with the independents, constituting another challenge for them as they look to set up camp in Italy.

“In our country we have a system of relationships that is quite different from those of other operations,” explains Maggi. “Senior lawyers have been able to keep the relationships with banks and companies at the highest level.”

Instead, the global firms have tended to focus on developing specific areas, with Cleary Gottlieb Steen & Hamilton consistently highlighted for its growth in the antitrust arena, while Linklaters is singled out for its banking expertise and White & Case for its capital markets work. This has left the independent firms to take on a large proportion of the employment, tax and litigation matters, and they have been making the most of multiple opportunities in the market.

“Litigation has normally been handled by the smaller litigation boutiques,” says Gianni. “But now arbitration is coming to firms such as ours because litigation is more complicated.”

There have also been changes to the voluntary disclosure laws, which have particularly benefited the tax practices of many Italian firms. The laws mean people can regulate their tax position on assets made or held abroad that have not been declared in a tax return, and provides for an exchange of information between nations such as Italy, Monaco and Switzerland.

The next big thing

But what is next on the horizon for Italy? It could be the year of privatisation after the national post office Poste Italiane debuted on the Milan Stock Exchange in October. As part of prime minister Matteo Renzi’s privatisation drive, the state-owned railway group Ferrovie dello Stato is also set to be part-sold as the government looks to improve the country’s economic climate. ““The government has gained credibility with the EU as a result of the current privatisation programme,” observes Gianni.

There is also the expected increase in activity in certain sectors, including telecoms and pharmaceuticals. With Novartis and Sanofi both present in Italy, the pharmaceutical sector is understood to be on the up in this area, reflecting the worldwide boost in activity for the sector.

“Investment companies are looking at the business world on a global level and trying to diversify their investment portfolio”

“We are well-positioned in the pharma market but wanted to improve our reach in this area,” says Simontacchi. “Our strategy is to try and find the niches such as pharmaceuticals, as well as areas including patents, transfers, environmental, criminal law and regulatory banking law.”

The independents additionally believe they will win work as part of the Government’s long-term broadband strategy, which intends to ensure that 100 per cent of the population have access to 30Mbps broadband by 2020. Around €2.2bn has been allocated to the Development and Cohesion Fund for high-priority investment, while an extra €2.7bn of funding may be granted giving the project a total of €4.9bn.

So the future looks bright for the Italian independents, who are seeing an uptick in M&A, private equity, tax and banking work as a result of government reforms and economic improvements. As the number of companies looking to invest in and out of the country seems likely to increase in 2016, the opportunities will continue to blossom on both a domestic and global scale.