Few major businesses have been through as much change as BT has in recent years. Five years ago the company was facing a global revenue loss of £134m for the March 2009 year-end compared with a profit of £2bn in 2007/08. As a result BT had been forced into a wholesale reinvention of the business, a move that had stark consequences for the in-house legal team, with deep cuts made to the legal capability both in terms of headcount (down by 20 per cent) and budget.

Jump forward to 2016 and BT has just secured its takeover of the UK’s biggest mobile operator, EE (Everything Everywhere), a deal that will bring with it significant additional in-house legal resource. The man who had been tasked with cutting the in-house legal spend year-on-year and now faces the challenge of integrating the EE team is general counsel Dan Fitz. But this is much more than a story about one man.

Call in the GC

Fitz was appointed to BT’s top legal role in 2010. Since then he has reinvented the in-house team, overhauled relationships with external counsel and installed an ABS structure.

The aim? To turn BT’s legal team from a loss-making revenue stream into a profit centre.

Fitz arrived at BT in April 2010 from his position as GC and company secretary at Misys. Much of his working life has been spent in-house, with the lawyer having spent 11 years at Cable & Wireless as GC prior to joining Misys in 2003. Before joining BT Fitz had taken a year out to care for ageing relatives in the US.

The sheer scale of the BT Group and the financial challenges it was facing post-2008 were on another level to his previous roles. The business was expanding into mobile and television, while the mantra of ‘doing more for less’ was bang on trend.

“As a sector we’re under a lot of pressure because our revenues are going down but our quality is going up,” Fitz says of the business today. “We’re all faced with the same environment, it is unforgiving financially for everyone in telecoms.”

Fitz kick-started the BT revolution by changing the way the in-house team was structured. In early 2011 lawyers who were once managed according to who they worked for became managed according to what type of work they did.

“We had 26 teams in the function doing the same work and that didn’t make sense,” Fitz admits.

“The solution was to manage people by what they do – litigation, commercial and, in part, competition. It was about grouping people together so that they could be managed centrally and work could be appropriately allocated, because the volumes were going up.”

BT commercial general counsel Chris Fowler, who has been with the business since 1998, says the in-house team desperately needed to demonstrate that it could add value.

“In 2010 being busy meant more people but that wasn’t sustainable,” says Fowler. “We needed to look at where we added value. The big issue in 2010/11 was that lots of people thought that they were doing the right thing when actually they weren’t.”

Bringing lawyers together into cross-company teams meant they began talking and knowledge sharing, Fitz says. Lawyers were encouraged to work for the business as a whole rather than certain business streams. This had an impact on how work was being allocated to individual lawyers in-house.

“The biggest change was that we consciously managed demand,” Fowler recalls. “We asked people to allocate times to certain activities. There was formal matching between the cost of a person and the value or complexity of the task.”

This could be fed back to the wider business, which was told to send work to the in-house team via a ‘front door’ portal so that it could be properly allocated to the right person rather than just being sent on an ad hoc basis.

Fitz says the chief executives of the various business streams needed to be persuaded that the new system would save time and money.

“They trusted me enough to change the status quo,” he reflects. “Change is inevitable. Why not just get on with it? It’s not just about how to do more for less but also about having that work-life balance.”

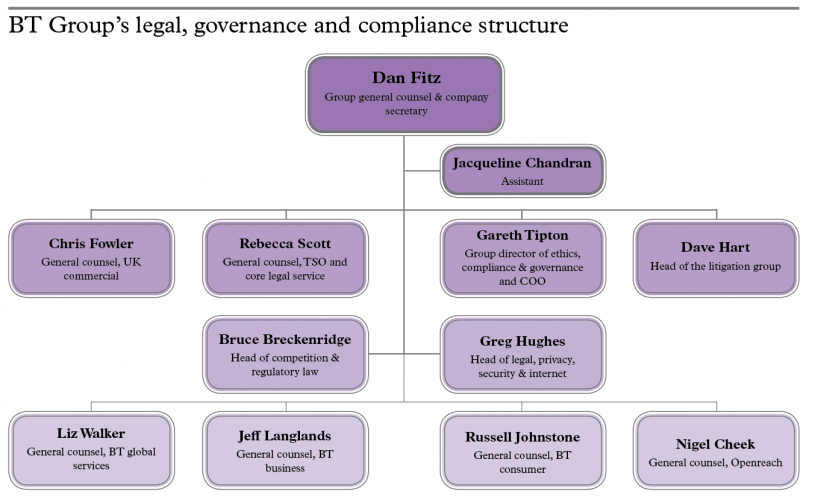

As well as reorganising the in-house team structure, the compliance team, led by director of compliance and COO Gareth Tipton, merged with the legal team. Combined, the in-house group is now made up of around 480 people worldwide, including an 80-strong compliance team.

Fowler says it was essential that the in-house team changed the way it worked to meet the wider demands of the business.

“The key thing is to make a virtue out of a necessity,” he argues. “We didn’t have the choice but to change. We couldn’t say that this doesn’t apply to us when there were changes in customer services, engineering [and many other departments]; we all had to change. Just as they were unable to argue that they needed more people, we couldn’t.”

Changing how the in-house team was structured was just one piece of the overall plan for the legal team. What was, and remains, essential was to bring about change in how in-house lawyers work with external counsel.

Switch advisers

Fitz completed his first review of external advisers in January 2013. He tore up the traditional referral methods and replaced the formalised panel process with a preferred network of suppliers.

In April 2013 Gateley joined media specialists Sheridans and Wiggin on the framework, reflecting demand for broadcasting law expertise ahead of the launch of BT Sport that year. Long-term advisers Bird & Bird, CMS Cameron McKenna and Freshfields Bruckhaus Deringer maintained their relationships with the company.

COO and compliance chief Tipton, who is just beginning to scrutinise the supplier list for a second time, says the preferred supplier network is favourable because it offers a degree of flexibility.

“A number of years ago we had a formal panel and we moved away from that,” Tipton says. “I’m contrary to the benefits of a panel and like the flexibility of preferred suppliers.

“It’s been really successful and we want that to continue. We want more regional firms. There is a benefit to working with firms like Bird & Bird and Freshfields but I want the ability to access regional and boutique firms.”

The new network will be expected to service the needs of an expanded business. In January BT received regulatory approval for its planned £12.5bn takeover of rival EE (see ‘EE – the next stage in BT’s transformation’, right). The deal, which will have implications for the preferred supplier list, closed on Friday 29 January.

“We’re changing our business,” Tipton says, mentioning the introduction of both BT Sport and BT Mobile. “We have to look at these things differently. We need a broader array of firms.”

Fitz is remaining tight-lipped on the implications of the EE acquisition. But with an EE legal team of around 90 led by GC James Blendis, the deal is likely to have consequences for BT’s in-house team as well as its external advisers.

Fitz is happy to confirm that integration will be a key priority in 2016. On plans for a review of the preferred suppliers list, he adds, “this is a big acquisition and [preferred supplier] firms need to understand the needs of the business.

“The big change is that this time it is likely to look at all three party suppliers – legal, governance and compliance. We want to make sure we have total value suppliers, so everyone will be looked at, not just traditional firms and alternative suppliers.”

Alternative route

BT has long been a fan of working with alternative legal services providers and legal process outsourcers (LPOs). Halebury and Obelisk both count BT as a client, supplying lawyers on a secondment basis. Fitz and his senior team believe firmly that the LPO sector has brought about competitive tensions in the legal market that benefit clients.

The company was among the first to move into this space when it launched a ‘captive’ LPO base in India in 2005. In 2010 the base was closed after BT signed a deal with UnitedLex agreeing to send basic legal tasks to the company’s India offices.

In 2014 Axiom replaced UnitedLex as BT’s LPO of choice. In a groundbreaking move BT agreed to send work to Axiom in the UK, US and Asia, particularly in relation to commercial contracts, including contract negotiation. Axiom also took over work previously carried out by UnitedLex, including antitrust work and transactional support. Axiom offered additional support by way of 25 lawyers and paralegals working from its bases in Belfast, Houston and India.

Fitz wanted his in-house team to become more focused on dealing with higher-value legal work. Sending out higher-volume, low-value work to an LPO for an annualised fixed fee was a no-brainer.

Axiom feeds back to the company dashboards that allow BT to view the contracts it is working on by type, geography, counterparty, originating requester, source of terms, business line, legal entity and date, and the status of each.

“It’s not just about standardising [processes],” says Fowler, “but bringing that discipline in-house. This strategy is fundamental to bringing down our cost of sale.”

The relationship with Axiom will be examined again later this year.

“When outfits like Axiom and NewGalaxey can handle the complexity of our work it means that there are more options for us,” says Fitz. “It’s driving a lot of interesting conversations.”

For now the senior legal team’s focus is on the preferred supplier list and how those firms can be encouraged to collaborate with alternative legal suppliers.

For Fitz, Fowler and Tipton the relationship between traditional firm and LPO is not nearly mature enough.

“The collaboration between old and new firms is not happening…from my point of view that is unacceptable,” Tipton says candidly, adding, “we expect all legal suppliers to work together, to collaborate and share information. It’s about having that right mindset.”

As part of the review, the senior in-house team will take a closer look at how work is being farmed out and what impact that is having in-house. Process mapping has become the buzzword of the moment. Fowler says by standardising workflows, referrals become less artisan and less onerous – in other words, they could cost less.

Against a backdrop of natural conservatism in the law Fowler believes innovation in the business of law is easy to come by. Indeed, he believes its very nature promotes this.

“The thing I find most fun is that there are so many opportunities to do things differently in the law because it is so inherently conservative,” he enthuses. “There is a huge opportunity to challenge the traditional way of thinking.”

An ABS with a difference

Fowler was instrumental in the development of BT Law Limited, the company’s subsidiary ABS. Headed by chief counsel and director Archana Makol, the success of BT Law is essential if the in-house team is to be turned into a profit centre.

BT Law is an ABS with a difference. It has no lawyers in-house as such but takes them on secondment from BT’s own team. It focuses primarily on the road traffic accident (RTA) sector as well as public liability and employers’ liability matters.

Makol says BT has honed its services over 20 years and picked up trends in its chosen sectors, which can then be applied to clients of BT Law. Clients include EDF and Network Rail as well as XL Insurance and BT Group.

The development of BT Law has not been without its challenges. As well as overcoming regulatory hurdles in a brand new area, there are competitive tensions between BT Law and other legal service suppliers, such as Axiom.

Fowler says BT Law is all about driving external revenue into the legal team. That revenue will offset the 5 per cent year-on-year savings that Fitz has been tasked with making.

For now BT Group is happy enough with its relationship with Axiom but in the longer term, questions could be raised about this relationship and how BT Law could be better utilised.

EE and after

With the EE deal now closed there is little doubt that 2016 will be a transformative year for BT Group. That will inevitably have an impact on the in-house legal team. With so much already achieved by Fitz and his team, you might be forgiven for thinking that it’s time to let the dust settle. You would be wrong.

The key to innovation is to never stand still, always be ahead of the competition and continually strive for new ways of working. Fitz and his team have responded to the 5 per cent annual budget cut with gusto. They have introduced

new ways of working and taken time to assess external relationships while investing in a novel ABS structure.

The result is that despite more change on the horizon, BT’s lawyers are in good shape to deal with whatever comes down the line.

EE – the next phase of BT’s transformation

Rachel Canham – Mergers chief counsel

Since BT sold O2 in 2001, its business strategy has focused on network, television and telephone offerings.

Since BT sold O2 in 2001, its business strategy has focused on network, television and telephone offerings.

In February 2015 BT Group finalised plans to acquire Britain’s largest mobile operator EE from Deutsche Telekom

and France’s Orange in a deal worth £12.5bn.

The Competition and Markets Authority (CMA) spent the latter half of 2015 scrutinising the deal and finally gave its approval on 15 January after ruling in October 2015 that it did not consider the proposed merger would “have a significant effect on competition…”. The deal closed on 29 January, with Deutsche Telekom and Orange receiving shares in BT (respectively 12 per cent and 4 per cent, with a representative of Deutsche Telekom set to be appointed to the BT board in due course).

The last year has been one of the busiest for BT mergers and acquisitions chief counsel Rachel Canham. She spent much of the year working on the legal, governance and compliance integration planning of EE into BT, now it is time to put that plan into action.

Canham wrote the rulebook for how BT executes acquisitions, drawing on lessons learned from previous deals.

GC Dan Fitz says the deal will have an impact on the in-house team. EE is home to a 90-strong legal team headed by general counsel James Blendis. It will be integrated into BT Group.

“The EE integration is the next phase of our continued transformation journey,” says Fitz. “The destination principals are the same: more for less, moving people up the value chain, reacting when people retire or leave and alternative providers.”

The biggest litigant in the FTSE 100

Dave Hart – Head of litigation

BT litigation head Dave Hart arrived at the company in April 2015 from Barclays where he headed the disputes functions for personal banking, wealth, Barclaycard, operations and technology for the EMEA region.

BT litigation head Dave Hart arrived at the company in April 2015 from Barclays where he headed the disputes functions for personal banking, wealth, Barclaycard, operations and technology for the EMEA region.

Hart says he was attracted to BT not only because it is a new industry but because it is one of the few corporates “thinking outside the box”.

While Fitz will put the preferred suppliers list under review this year, Hart is looking to strengthen relationships at the bar.

The company has relationships with sets including Pump Court and Devereux Chambers, but, says Hart, “there is no exclusivity there”.

Any new framework, he adds, “needs to be beneficial to both parties and needs a degree of flexibility”.

Hart continues: “There are certain chambers that are keen on being innovative. This is a process we are looking at and asking ourselves, ‘have we got the right chambers?’ and ‘have we got the right people?’”

For any chambers looking to build a formalised relationship with BT the rewards could be rich. According to The Lawyer Market Intelligence (LMI) BT Group is the most prolific litigator in the FTSE 100 when it comes to court disputes with commercial opponents and the Government.

Between January 2012 and July 2015 it was named as a litigating party 23 times, including five appearances in the Court of Appeal and once in the Supreme Court.

There have been six cases involving the communications regulator Ofcom, two against the Secretary of State for Culture, Olympics, Media and Sport and one involving the Competition Commission.

Which set is BT Group most likely to instruct in the competition disputes sphere? Monckton Chambers.

Of those nine cases in which BT was represented, the telecoms giant turned to Monckton four times for a lead silk. It turned to the set for advice on competition law matters, bringing in top competition silk Jon Turner QC twice, and Daniel Beard QC, Meredith Pickford QC and Christopher Vajda QC on one case each. Vajda has since left chambers after being named as a judge in the European Court of Justice (ECJ). Including instructions for junior tenants Monckton was brought in on cases by BT seven times.