One of the key events that defined Ireland’s legal market in 2017 was the opening of several new offices by international firms in Dublin.

In June 2017, Pinsent Masons became the first UK firm to announce its plan to launch an office in Dublin since the UK’s Brexit vote. US firm Covington & Burling followed shortly, unveiling the hiring of Beauchamps lawyer Maree Gallagher, who will launch a small presence to focus on life sciences and technology practice for the firm.

Towards the end of the year, Simmons & Simmons finally pulled off its long-planned Ireland expansion, which is led by former Mason Hayes & Curran head of investment funds and financial regulation Fionan Breathnach.

Of course these are by no means the first moves made by international firms into the Irish legal services market, as a good number of foreign players already have an on-the-ground presence. They include Eversheds Sutherland, DAC Beachcroft, DWF and Kennedys, US firm Dechert, and offshore firms Maples and Calder and Walkers.

But the latest wave of firms entering the market signals the Irish legal market’s growing importance for larger and full-service players. There is currently plenty of speculations as to whether and when the largest global firms will set up shop here, particularly the likes of Baker McKenzie, Dentons and DLA Piper.

International firms in the market say Ireland in itself has been an important market given its strong-performing economy and employment market, while Brexit has provided a catalyst to speed up the process of more overseas arrivals.

The two newly-landed UK firms in particular are especially bullish about the growth prospects for them in Ireland.

In Simmons’ case, its new Dublin office is set up initially to target the firm’s asset management clients, but the firm has the ambition to develop it eventually into a full-service outlet.

“Ireland is an important market for establishing funds that will be marketed generally throughout the European Union and for structuring financial products. The Dublin office will help cement our position in these two sectors and it’s very important for us to be there,” says Colin Leaver, partner and head of asset management and investment funds at Simmons.

Simmons’ ambition to open in Dublin has been known in the market for several years. The UK’s decision to leave the European Union in 2016 has helped the firm get the proposal through, but Leaver said the move was not driven by the Brexit.

“Brexit has definitely helped with the decision, but not driven it. Undoubtedly, Brexit will bring up more opportunities for Dublin, as companies and investors are potentially relocating current businesses into various jurisdictions of the EU,” says Leaver.

Along with Leaver, Richard Perry is another key partner spearheading Simmons’ Dublin expansion. Although the firm’s new Dublin office won’t officially open until the first quarter of 2018, he outlines the growth plan in the country, which are more ambitious than many of the existing international firms in the market that prefer to maintain a small and niche offering.

“We’d like to have 10 partners in Dublin over the next three years. The core team in the office will be locally recruited, people who are well-established practitioners in this market,” says Perry. “The Irish legal market has been dominated by established independent Irish firms. But we think it is in the course of changing, and we expect to play our part in that process.”

International disrupters

Pinsents shares a similar rationale and optimistic outlook as its UK rival Simmons. Its new Dublin office has been in operation since October 2017 and is looking to reach a critical mass of 70 staff by October 2018. More importantly, it is poised to be a “disrupter” of the market with a different proposition.

“Dublin presents a fantastic opportunity for the firm, as it is a hub for the financial services and technology sector. It’s been on the firm’s radar for a while and we made the decision at the board level to explore options of entering the market even before the Brexit vote,” says Dennis Agnew, a founding partner of Pinsents’ Dublin office who joined from local firm Byrne Wallace last year.

“Brexit makes it an even better decision for us. But our view on the market would be the same if Brexit didn’t happen,” he insists.

Agnew’s enthusiasm is built on a sizeable client base that Pinsents already has in Ireland. Under the firm’s ‘Atlas’ client relationship programme, there are 250 firm-wide leading clients, and 50 of which are already in Ireland, according to Agnew.

“We’re already working on five transactions, primarily involving international clients acquiring Irish companies or setting up greenfield sites here. Of those five deals, the majority are in the space of technology and financial services. The pipeline for 2018 is looking strong,” says Agnew.

Pinsents’ optimism is also fuelled by Irish clients’ feedback on the need for “disruption” in the mature market.

“The Irish market is a mature and sophisticated market. But when we did our due diligence by talking to clients, they felt there was room for disruption, firms that are large and doing things differently,” Agnew recalls.

“We’re here to disrupt the market, not to damage other firms. We will compete hard but in good spirit,” he vows. “There’s nothing really new in the market for a while. We’v come in to build a large office and offer a different proposition. Some other international firms will do the same. It is very different from one or two years ago. I’ll be surprised if we are the last international firms to come in and look to make a big splash with a competitive Irish practice.”

Expansion of existing international players

Among the international firms that have been in the market for some years, Eversheds Sutherland and Maples and Calder have built up a larger presence, offering a wider range of services and competing in the same space as the leading domestic firms.

Both firms entered the market via mergers with smaller, local firms but have since grown significantly. Furthermore, they do not intend to slow down their expansion in the market.

Maples launched in the market in 2006 by taking on local boutique Binchy’s. At the time of the merger, the firm had a total of 35 staff, but headcount has multiplied over the past 11 years to reach over 230, including 113 fee-earners and 35 partners. The size of Maples’ Dublin office is comparable to that of the firm’s head office in the Cayman Islands according to Dublin managing partner Nicholas Butcher.

“We’ve always been serious about building a full-service offering here and that strategy has been part of our success,” insists Butcher. “Niche practices can also work in the market but it’s not the direction we’ve taken. We’ll see how the new entrants to the market develop over time. But there’ll certainly be stronger competition from all angles.”

In a bid to strengthen its position in Ireland and secure more inbound work from the UK, particularly in light of the pending Brexit process, a number of Dublin-based partners and associates have recently relocated to the firm’s London office to set up an Irish desk.

“Notwithstanding where Brexit may move the market, clients want to have Brexit and EU law-related regulatory advice and transactional legal services to help them retain rights to the EU markets. That could certainly involve products and services from Ireland. London is a big market for Irish legal work, and we don’t think that will change,” says Butcher.

In addition to global referrals, Maples also plans to grow its services with strategic hires in several key sectors including data, technology, intellectual property and pharmaceutical.

“We certainly do want to continue to build out a full-service offering in strategic areas, which are likely to grow and be complementary to our clients. We’ll grow by making strategic lateral hires as well as by promoting and developing from within our existing talent pool,” he adds.

The fast-growing Irish economy lays a solid foundation for many firms’ growth plans. At the end of 2017, the European Commission predicted that Ireland’s GDP growth would remain “robust” at above 3 per cent up to 2019 and 4.8 per cent in 2017. That would make Ireland the fastest growing economy in the Euro zone for a fourth straight year.

“The Irish economy is doing well and is spinning off a significant amount of work to law firms. Ireland still has a big play to make to position itself to international enterprises and global firms. There’ll be more work and need for international firms to service that work,” predicts Butcher.

Although their global footprints, strategies and practice focuses vary widely, Eversheds Sutherland’s growth path in Ireland is not dissimilar to Maples. In 2005, legacy Eversheds set up a presence via a tie-up with Irish firm O’Donnell Sweeney. Since then it has developed into a full-service outlet of 280 staff, including 110 lawyers and 32 partners while the firm’s revenue from Ireland has been growing at an average annual rate of 15 per cent over the last four years.

In 2017, Eversheds Sutherland experienced particular strong demand for corporate and M&A advice as well as in relation to real estate transactions and IP/GDPR (General Data Protection Regulation)-related advice particularly concerning Ireland’s booming technology sector.

Apart from mandates prompted by Brexit, such as acting for a number of financial services institutions to relocate part of their businesses to Ireland, US companies’ investments into Ireland has provided additional opportunities for the Dublin office thanks to Eversheds’ transatlantic merger with Sutherland last year.

The firm’s Dublin managing partner Alan Murphy believes that being part of an international firm has been a significant contributor to the Dublin office’s growth, both in terms of size and top-line growth, and is a strong advocate for the internationalisation of the Irish market.

“The US has been a major source of foreign direct investment in Ireland. There are lots of synergy from the clients’ perspective between us and Sutherland,” says Murphy. “More specifically, we’re looking to leverage Sutherland’s expertise in aviation leasing to do more in that area in Ireland and grow our existing tax practice exponentially with the Sutherland relationship.”

Murphy also names Eversheds Sutherland’s consulting business as a priority to focus on in Ireland. The Dublin consulting team has been busy following the appointment of Ciaran Walker, formerly the deputy head of enforcement with the Central Bank of Ireland, as a consultant in October 2016.

“Another reason behind such new opportunities for international firms in Ireland is that things are run along the traditional lines in the established domestic firms. International firms can bring a breath of fresh air,” Murphy argues. “I do believe there is room for alternative service providers in the Irish legal market, which is proven by our own growth. However, it’s a sophisticated market and my advice to international firms that are interested in the market is to enter via acquiring a local firm.”

Even for the international firms traditionally with a niche focus, the desire to expand is increasingly evident. Dechert is a case in point. It was the first US firm to set up a base in Dublin back in 2010 and its 10-lawyer Dublin team has been solely focused on financial services and funds. But Dublin partner in charge Declan O’Sullivan says the firm will look at other areas opportunistically.

“Dublin is a global centre for investment funds, aircraft leasing and IT. The market is performing well above average in terms of the provision of legal work, as several key industries require a high degree of sophisticated legal support,” says O’Sullivan. “We would be interested in expanding opportunistically, in areas including financial real estate, securitisation and maybe corporate.”

Another manifesto for Dechert’s growth plan in Ireland is the recently launched trainee programme, which will see the firm take in two or three trainees in Dublin each year to facilitate the growing workload.

Potential for consolidation

While all of the three new entrants in 2017 have established their Dublin presence via a greenfield project with local hires, there have been constant whispers of merger talks in the market in recent years.

Pinsents was one of the firms that was said to have explored merger options with several local Irish firms before finally deciding to launch on its own.

A recent survey by accountancy firm Smith & Williamson confirms the interest from international suitors and shows the level of merger activity within the legal sector is expected by most respondent firms to increase over the next year.

According to the results, 56 per cent of the country’s top 20 firms were approached by an international firm for a potential merger or team acquisition in 2017. The percentage was even higher in 2016 at 69 per cent. The report also points out that around 44 per cent of the top 20 firms were approached by a UK firms in the last 12 months primarily as a result of Brexit.

However, for all the discussions taking place, few mergers have actually happened. Uncertainty around how Ireland will be affected by the UK’s Brexit will hold back many firms’ final decision on expansion into Ireland.

“There is bound to be additional consolidation in the market over the next few years but the question is at what level and that is a hard one to answer,” predicts Mark Thorne, managing partner of Dillon Eustace. “Certainly international connectivity will be a factor into the future and we’re lucky to have a lot of close links with international firms around the globe. Given recent trends of international firms consolidating their offices to key jurisdictions rather than expanding their footprint it is difficult to predict a wave of mergers, but closer alliances may well be formed.”

In Thorne’s view, a soft Brexit will lead to no real driver for major change, whilst a hard Brexit may have a negative impact on the local economy with limited gains in financial services. This would make it therefore hard to see a significantly increased need for a larger group of law firms as demand and local activity could contract.

Irish firm Beauchamps’ managing partner John White also sees Brexit as a lesser driver for mergers.

“Successful law firms are always looking for ways to expand and strengthen so that will continue. Mergers are a feature of the evolution of professional services firms but I don’t expect a glut of mergers in the short term. At the moment I think a key driver for merger activity will be the need to make significant investments in technology, not Brexit,” says White.

Rising competition

All of the top-tier Irish firms The Lawyer spoke to for this report expressed strong confidence in maintaining their leading position as independents in their home market, despite the increasing number of international rivals in town. The general consensus in the local community is that the existing and new international firms are yet to make a real impact on the market, but changes are coming and no one is complacent.

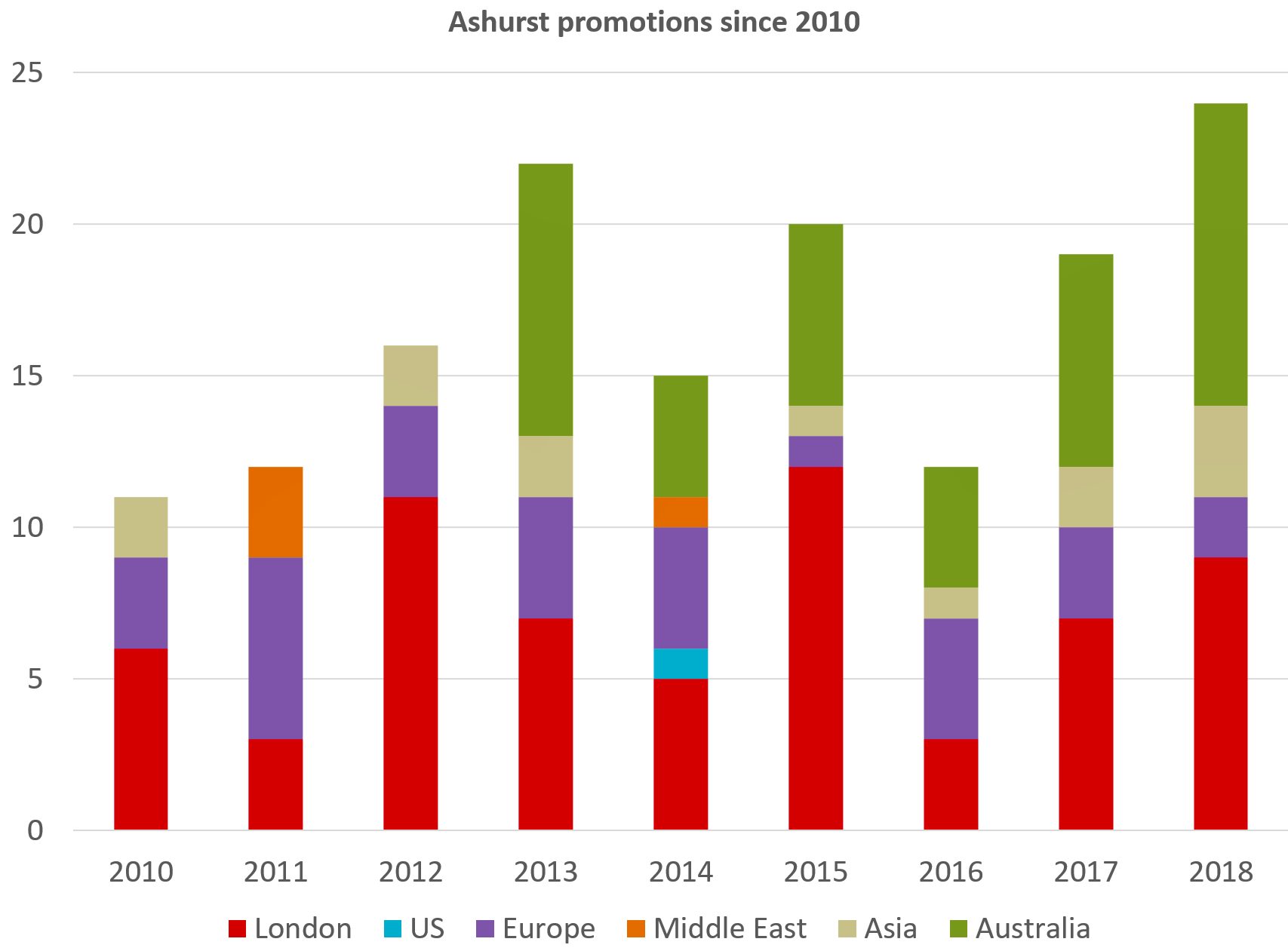

The leading Irish firms’ confidence is built on their stellar track-record of growth since the 2008 global financial crisis (see chart on page ????) and a solid year in 2017.

Ireland’s second largest firm A&L Goodbody, for example, has expanded its total number of staff from around 500 to almost 800 in the past eight years. Its annual turnover has also grown substantially, up 63 per cent from an estimated €85m in 2009 to estimated €138.3m in 2016. According to managing partner Julian Yarr, 2017 has turned out to be another good year.

To Yarr, and other managing partners in top-tier Irish firms, the market has gradually become more international over the past decade, and internationalisation is not a completely new phenomenon.

“The market has grown exponentially over the past decade. The sense is that we’ve been taking market share. The existing international firms in the market are perceived as have come here for specialist opportunities,” says Yarr. “But a new group of firms, the likes of Pinsent Masons, are looking at ambitious growth plans based on a strong Irish economy and existing clients.”

Brian O’Gorman, the managing partner of Ireland’s largest firm Arthur Cox, shares a similar observation.

“Most foreign firms would appear to have a niche and small practice here. We haven’t seen a major global firm come in with the intention of competing with the top Dublin firms in mainstream practices such as corporate and M&A, litigation, real estate and banking and finance. International firms haven’t made a dramatic impact on the market yet,” he argues.

For now, the top domestic firms’ biggest competitors remain to be their existing domestic rivals as they have been over the past 20 years. That said, while the existing and new international players’ impact on the market is not clear yet, the trend of decreasing referrals from several UK firms and the increased competition has definitely been felt.

Traditionally, the Irish firms have enjoyed cordial referral relationships with most of the large US and UK firms. With more of their “referral friends” setting up shop in Ireland and practising Irish law, the dynamics of the relationship will inevitably change and competition for work will slowly creep up.

“We’re likely to see a slight decrease in referral activity from a few firms. But we will focus on growing the flow of our referral network globally,” predicts O’Gorman.

William Fry’s managing partner Bryan Bourke says that the Irish legal market is already incredibly competitive among a small number of large domestic firms and expects the growing number of players in the market will only add more competition in many ways.

The first and most affected area has been on the talent and recruitment front. The vast majority of the international firms’ expansion in Ireland has been achieved by hiring experienced partners and associates from local firms.

“Obviously the war for talent and hiring is likely to be increased if many firms come here. The arrival of new international firms has certainly pushed up salary levels,” confirms Bourke. “But at the same time, they also continue to push up the standards here in the market. It’s about being agile and adaptive, and looking out for the best people and opportunities.”

In response, local firms are taking various approaches and initiatives to keep them as a more attractive option to their clients and talent alike.

Mason Hayes Curran, which achieved a 42.9 per cent revenue increase between 2012 and 2016, is also gearing up for more competition. For example, it hired a director of client service at the end of 2016 to lead the development of the firm’s client service standards and process efficiency as well as to promote the use of new technologies and other innovations. In 2017, it also opened a new international office in San Francisco and launched a new debt capital markets practice with the hire of former Linklaters managing associate Joshua Pileggi.

At Arthur Cox, the management’s focus over the next few years will be on talent-related issues, such as improving diversity and building an inclusive culture, as well as supporting agile working.

“We’re looking at things we can do to make sure we stay ahead of the market. We’re also making sure we use technologies to invest in the best way of client services and talent utilisation,” says O’Gorman.

A&L Goodbody also vows to invest constantly in its people and clients and focus on staying “super hungry and ambitious”.

On the talent side, the firm recently hired partner Conor Owens from Maples and Calder to strengthen its construction practice. In May 2017, it also overhauled its talent training strategy by teaming up with University College Dublin to launch a School of Business and Law. The new programme offers an integrated learning and development programme for all lawyers, as well as support staff, with a focus on the skills relevant in a post-technology environment.

As Mason Hayes Curran managing partner Black sums up: “Changes are coming. But the degree of change remains to be seen.”

It may be an overstatement to say the growing presence of international firms will result in a major shake-up of the Irish legal industry, but their increased investment in Ireland is sure to disrupt the status quo eventually. At the very least, it is bringing a breath of fresh air to a long mature market.

The post Dublin analysis: Disrupting the status quo appeared first on The Lawyer | Legal insight, benchmarking data and jobs.

Monzo works by connecting your card to the Monzo app on your phone. Every time a purchase is made the app logs it, deducts it from the total you topped up with and alerts you about how much was spent and what the day’s total is. And, as always, the business throws out a range of legal issues for its lead lawyer to handle.

Monzo works by connecting your card to the Monzo app on your phone. Every time a purchase is made the app logs it, deducts it from the total you topped up with and alerts you about how much was spent and what the day’s total is. And, as always, the business throws out a range of legal issues for its lead lawyer to handle.